DOWNLOAD “SONIC WEAPONS: The Official Stereo Thesis Music Sampler FOR FREE.” To get your FREE full-length album…click here.

_________________________________________________________________________

(To read Part 1 of "The Basics of Gold and Silver Investing: A Musician’s Guide to Speculating and Profiting with Precious Metals," then click here.)

Gold and Silver Mining

Company Stocks and ETF’s

This is a more direct asset play because the asset and the product of the company are one and the same – gold or silver in their raw forms. There are 2 ways I know of to approach this method of investing and they are to invest in individual gold and silver mining companies or to put your money into a gold or silver mining ETF. An ETF is an exchange-trading fund. It trades like a stock but sometimes the underlying asset is not a stock. Instead, sometimes it could be a collection of stocks of a certain classification, economic sector, or commodity. In this case, a gold or silver mining ETF would be a fund which holds the stock of several gold or silver mining companies. So instead of investing in a single mining company, you’d be diversified among several such companies.

It’s easy to find individual gold or silver mining companies in which to invest. A simple Google search or a look into the top holdings of a gold or silver ETF will yield many results. But in many cases you’ll notice that the Google searches and the top holdings inside a gold or silver ETF result in similar findings because there are so few gold and silver mining companies in the world.

To see what I found from a quick Google search for gold mining companies and their stock symbols, click here.

And to see an example of what company stocks make up the top holdings inside the gold ETF, GLDX, click here.

More on Gold and Silver ETF’s

The next approach to investing in gold and silver is a

little more advanced than the earlier techniques. I strongly recommend that you

gain some amount of experience investing or studying the earlier techniques

before using these. This way you lessen the chance of making beginner mistakes

with your money. Without investing directly in the commodities exchange (futures market), you can get exposure in commodities by using commodity ETF’s. Commodity ETF’s allow you to invest in commodities such as coffee, tin, sugar, corn, oil, timber, natural gas, chocolate, livestock, as well as gold and silver. The only other way to invest in the commodities market is to find an investment firm or hedge fund that deals in this market. Usually an account with such a firm or private equity fund requires a high initial investment, high financial I.Q., or high net worth.

Now, the most fundamental way to start looking at investing

in gold and silver using ETF’s is to simply place your money in one and watch

its value go up and down, but hopefully higher and higher over time. Two ETF’s

that provide this most basic form of gold and silver commodity exposure are SPDR Gold Shares (GLD) and iShares Silver Trust (SLV). Neither of these ETF’s offers shorting or leverage as part of their

characteristics.

Shorting Gold and SilverAs I already mentioned earlier “shorting” is a trading technique that allows you to make money when the price of something goes down. Below you’ll notice a chart with 2 lines that appear as mirror opposites of each other. The green line represents the gold ETF (GLD), which tracks the price gold, and the blue line is another gold ETF (DGZ) that shorts the price of gold. Using these 2 investment tools and an assortment of technical knowledge about trading and gold itself, you can make money all the time whether the price of gold is going up or down. Theoretically, you’d be in GLD when the price of gold is going up and switch to DGZ when the price of gold is going down. In both scenarios, you’d be making money. Some traders actually specialize in following the price fluctuations of gold and make a living trading and shorting gold. You can also take the same approach to trading silver.

Gold and shorting Gold ETF's:

SPDR Gold Shares (GLD)

Silver and shorting Silver ETF's:

iShares Silver Trust (SLV)

ProShares Ultra Short Silver (ZSL)

[Note: Soon, I’ll provide a brief list of 2x leveraged short gold and silver ETF’s that give you twice the returns when the price of gold or silver is going down.]

Let it be known that it is

virtually impossible for you to time both movements perfectly, so while lots of

money could be made by using these 2 tools, lots of money can also be lost by

using them without some training or guidance. The worst case scenario would be

for you to incorrectly time the market and be in GLD when the price of gold is

going down. Then once again time the market incorrectly and be in DGZ when the

price of gold is going up, thereby losing money every time you trade. Read

books on the subject or find a mentor and proceed with caution.

SPDR Gold Shares (GLD)

DB Gold Short ETN (DGZ)

Leveraged Gold and Silver ETF’s (2X)

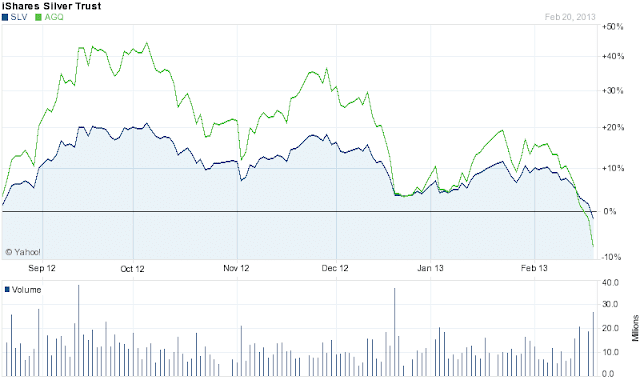

Earlier I wrote that leverage is a

way to quickly multiply gains (and losses). Well, here is an example of a

silver ETF, which tracks the price of silver, as compared to a leveraged (2X)

silver ETF, which tracks twice the value of the price of silver. Below you’ll

see a chart with 2 lines that appear to be duplicates of one another, but one

of them seems to have a greater magnitude than the other. That’s the 2x leveraged

ETF indicating twice the returns.

If you look at the right hand side of the chart, you’ll see

a series of percentages. Those numbers are telling you what the return rate is

for each of those ETF’s on any day over a period of 6 months. While they both

seem to be providing a decent rate of return, the point here is to notice the

difference between a standard ETF and a 2X leveraged ETF. The idea is actually

fairly simple to understand. Where (SLV) provides a 10% return on a given day,

week, or month, the 2X leveraged ETF (AGQ), provides twice those returns for a

total return rate of 20%. In another example, if SLV gives a return of 20%, AGQ

gives 40%. These returns are what you’d get if the price is going up, but what

happens when the price goes down?

Let’s assume that if the price does go down, you’d short

gold or silver and keep making money. But, on the other hand, let’s say that

you missed a signal or the indicators were unclear and you stayed in an ETF

like AGQ, while the price of silver goes down 15%. The result would be that you

just sustained a 30% drop in the value of your silver investment. So while

using leveraged (2x) ETF’s are a great way to make more money faster, there is

a downside and that’s you can also lose more money faster. Once again I

strongly suggest that you read books on the subject or find a mentor and

proceed with caution.iShares Silver Trust (SLV)

Below are a pair of 2x leveraged ETF’s, one is for gold and

the other is for silver. Now because I am not a financial advisor, these ETF’s are

intended as a reference for study and analysis, they are NOT investments that I

am recommending to you.

ProShares Ultra Gold (UGL)Gold and Silver 2X Short ETF’s

The following is a short list of gold and silver 2X short ETF’s that I thought would be a valuable addition to the information I’ve presented in this article. This list is also intended as a reference for your study and analysis. For more information on how to use these trading tools refer to the earlier sections in this article on shorting gold and silver and the benefits and dangers of leveraged ETF’s.

Exit Strategy

Every good investor needs an exit strategy. An exit

strategy is a plan an investor creates BEFORE he gets into an investment

usually to do one of the following:

1. Cut their losses early

2. To secure their gains after achieving a financial target

If you’ve done the due diligence and your research has paid

off with fair to excellent returns, then it makes no sense to have done the

work without keeping the reward. This is why an exit strategy is so important because

acting according to a plan eliminates some of the risk of investing. Having a

plan prepares you in advance for removing your money out of an investment.

Too often a novice investor makes the mistake of watching

their investment lose significant value, only to see it never regain it. In

contrast, an exit strategy that includes achieving a 20% gain in the value of

an investment protects that gain by alerting you to remove your money once that

target has been achieved. Likewise, an exit strategy protects your money by

planning for acceptable losses. In other words, an exit strategy can be stated

in such a way that you are seeking a 20% gain in the value of your investment

and that you will not sustain more than a 5% loss in the value of your

investment. Now, you’re in a much better position to watch your investment make

you money or to protect your investment money from taking on a catastrophic

loss.

In general, an exit strategy should be composed of at least

4 parts. In addition, to cutting losses and hitting a financial target, you

should also set a time frame and have a plan for where to move your money next.

How long are you willing to keep your money in the investment or how fast do

you want your money to appreciate? Your answers might range greatly from 2

weeks, 6 months, to 5 years. It’s up to you. Will you convert your gains to

cash or find something new to invest in and keep your money growing? You should

have some idea or know for sure what you’ll do with your money, afterwards, before

you get into the investment.

This concludes my presentation of “The

Basics of Gold and Silver Investing: A Musician’s Guide to Speculating and

Profiting with Precious Metals.” I hope you found this article helpful and will

refer to it often should you decide to begin an adventure investing in gold and

silver. Post your comments and questions below and good luck.

____________________________________________________Related Articles:

The Cash Flow Quadrant - What Is It? And What Should It Mean to Musicians and other Artists

____________________________________________________

P.S. To support

Stereo Thesis with a financial donation, click here.

Marc

http://stereothesis.bandcamp.com/

No comments:

Post a Comment